- On average many insurers typically limit the “off-premises” coverage for items to 10-15% of the overall amount of coverage they have, you may need more!

- Homeowner policies have internal caps. Example: Cap of $1,000 on jewelry

- If you don’t have renters or homeowners insurance that covers stored items shop around at various insurance companies and get quotes!

- See what various policies cover what in case of theft or weather-related events. Most storage facilities make you sign a waiver stating they are not responsible for lost or damaged items.

- Make a list of what you put in the storage unit!

Friday, March 23, 2012

Storing Your Stuff? Don’t Forget Your Insurance!!!

Monday, March 19, 2012

Filing a Homeowners Insurance Claim 101

Easy Ways to Make your Car More Fuel Efficient

Happy Monday!!!! The gas tank is getting closer to E and you pass a few gas stations and look at the price and think to yourself, “3.65!?!?” The gas price like almost everything else, besides the cost of homes, have increased over the years and it’s something that you need, just like car insurance The national average in February has reached a high of 3.65. Here are 5 tips that will make your car more fuel efficient.

Happy Monday!!!! The gas tank is getting closer to E and you pass a few gas stations and look at the price and think to yourself, “3.65!?!?” The gas price like almost everything else, besides the cost of homes, have increased over the years and it’s something that you need, just like car insurance The national average in February has reached a high of 3.65. Here are 5 tips that will make your car more fuel efficient.1.) Keep your air filter clean

2.) Check your gas cap

3.) Maintain proper tire pressure

4.) Avoid idling

5.) Change your driving habits

6.) Try to maintain your speed

Wednesday, March 14, 2012

Speed Demon Given Creative Sentencing

Monday, March 12, 2012

Be Greener this St. Paddy’s Day!

·

Telecommute!

In a recent study

it was found that staying home just twice a month can save the average American

$169 a year on gas! And we all know gas

prices right now are through the roof, no pun intended. Doesn’t mean become a homebody but walk, take

public transportation or car pool!

·

Telecommute!

In a recent study

it was found that staying home just twice a month can save the average American

$169 a year on gas! And we all know gas

prices right now are through the roof, no pun intended. Doesn’t mean become a homebody but walk, take

public transportation or car pool!Money Saving tips for 2012

Thursday, March 8, 2012

4 Years at Consumer United and Still Going Strong!

Tuesday, March 6, 2012

Electronic Proof of Insurance? Why not?

It’s absolutely crazy when you think of the things that we

can do on cell phones now days. I

personally can’t go anywhere without my cell phone or I feel naked. It was this morning on the train that I took

a look up from my iPhone and realized everyone around me were ALL on their

phones too! Just to think we used to

have those huge cell phones back in the stone ages, then the flip phones, then

color and pictures and now? There are

endless limits of the things you can do and crazy amounts of apps that make

everything, well, EASIER!

It’s absolutely crazy when you think of the things that we

can do on cell phones now days. I

personally can’t go anywhere without my cell phone or I feel naked. It was this morning on the train that I took

a look up from my iPhone and realized everyone around me were ALL on their

phones too! Just to think we used to

have those huge cell phones back in the stone ages, then the flip phones, then

color and pictures and now? There are

endless limits of the things you can do and crazy amounts of apps that make

everything, well, EASIER!Monday, March 5, 2012

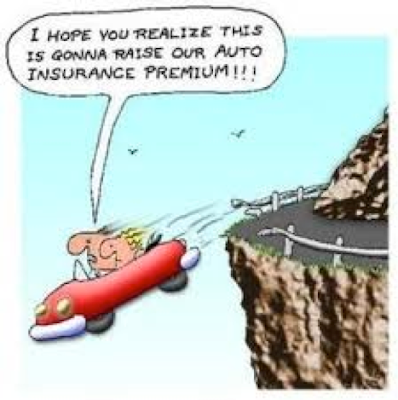

The ABC's of Auto Insurance

Comprehensive Coverage- This is not the same as COMPLETE

coverage. It only means that your auto

is covered in situations such as damage, theft or vandalism. NOT Collisions and of course a deductible

amount will apply.

Comprehensive Coverage- This is not the same as COMPLETE

coverage. It only means that your auto

is covered in situations such as damage, theft or vandalism. NOT Collisions and of course a deductible

amount will apply. Thursday, March 1, 2012

Renewing Auto Insurance for Dummies

- Anti-theft devices

- Multiple Policies with the same company

- College students living out of the house

- Defensive driving courses

- Drivers Ed courses

- Good credit record

- Higher deductibles

- Low annual mileage

- Long-time customer and loyalty

- Multiple cars

- No accidents

- No moving violations

- Student drivers with good grades- Honor roll students!

Consumer-Centric is the New Black

Friday, April 22, 2011

What happens if you didn't file your taxes on time?

Although the thought of filing late likely causes feelings of anxiety, it's certainly not something to fear. However, you must understand that there are penalties associated with filing your taxes after the deadline and the longer you wait, the more penalties you may be required to pay.

Tuesday, March 15, 2011

Inside Consumer United :: Jim Elliott

An advocate since June 2010, Jim Elliott has contributed to Consumer United with his work ethic and focus. The embodiment of the "work hard, play hard" adage, Elliott is direct and effective in his approach to helping consumers save money. "I find a way to solve my customers' insurance needs right away," he says.

An advocate since June 2010, Jim Elliott has contributed to Consumer United with his work ethic and focus. The embodiment of the "work hard, play hard" adage, Elliott is direct and effective in his approach to helping consumers save money. "I find a way to solve my customers' insurance needs right away," he says.Elliott believes it's key that a consumer understand the policy and process, and always takes the time to answer any questions. However, he also knows that people want this process to be efficient, which is why he views his roll as a problem solver.

Elliott adds, "If they need insurance right away I can put them at ease by providing proof of insurance in less than five minutes. If they are paying too much I can easily find the right insurance policy for them and apply additional discounts that they may not be aware they are eligible for."

Outside of Consumer United, Elliott enjoys the "play hard" side of life, frequently taking his competitiveness to the golf course.

This is not to say that he doesn't slow things down. As an East Coaster he enjoys fishing throughout New England and can be found off the coast of RI and MA in the summer or up in Northern Maine ice fishing in the winter months. Keeping with the belief that hard work and fun can go hand in hand, Elliott also enjoys brewing his own beer.

Hailing from Southbury, CT, Elliott attended the University of Rhode Island in Kingston, RI. He studied Finance and Leadership Theory learning not just the significance of value, but the importance of responsibility in business; lessons that have helped him greatly in his roll as a Consumer Advocate.

An avid sports fan, Elliott straddles the New England versus New York line, donning a Red Sox hat during the baseball season and Giants Sweatshirts during the football months. In Consumer United's Boston office this is a precarious line to walk, but Elliott doesn't hesitate to defend his sports views. Ultimately, Elliott is a true team player and an energetic and assertive supporter of the company and his colleagues.

Thursday, March 10, 2011

Alliance urges efficiency to combat gas-price hike

With the recent spike in gasoline and oil prices threatening the nation's fragile economic recovery, the Alliance to Save Energy urges consumers to make a solid commitment to energy efficiency as a way to counter rising oil and gas prices.

With the recent spike in gasoline and oil prices threatening the nation's fragile economic recovery, the Alliance to Save Energy urges consumers to make a solid commitment to energy efficiency as a way to counter rising oil and gas prices."Uncertain supplies plus ever-increasing worldwide demand can equal unpredictable price spikes," says Alliance President Kateri Callahan, "but energy efficiency can help us change that equation."

Callahan continues, "The 33-cent surge in gas prices over the past two weeks--reflecting today's $100+ a barrel oil prices – puts into sharp focus the urgent need to put energy efficiency at the top of the list of our nation's fuel sources in order to reduce our dangerous and costly oil dependence."

In addition, the Alliance advises consumers at their Drive Smarter Challenge website to be more fuel efficient by taking steps to minimize gas consumption, such as carpooling, emptying their trunks and ensuring their tires are properly inflated.

"We must continue to improve fuel economy standards and encourage the use of all-electric and hybrid vehicles as well as options such as telecommuting and public transportation," Callahan continues. "Public transit saves the United States more than 11 million gallons of gasoline per day, or 4 billion gallons annually," she adds.Weekly Deals: Save 80% on dining out

Deal Of The Week:

Deal Of The Week:Restaurant.com: Take 80% off $25 gift certificates from Restaurant.com with Consumer United's special code SAVE through Monday, March 14 here.

Other Weekly Deals:

Turbo Tax: Make tough times a little easier. File your simple return for FREE with TurboTax® Federal Free Edition. Click here to start saving.

Groupon: Groupon features a daily deal on the best stuff to do, see, eat and buy in a slew of cities across the United States. Click here to score today's Groupon.

Angie's List: As a Consumer United member, you qualify to save on Angie's List membership rates. Use promo code "LOCAL" for 15 percent off here.

Tuesday, March 8, 2011

How to snag a new $400 tax credit

Did you know that you can pocket some extra cold, hard cash this tax season thanks to the Making Work Pay tax credit? In 2010, a single taxpayer is eligible for up to $400 while married couples qualify for a maximum of $800.

Did you know that you can pocket some extra cold, hard cash this tax season thanks to the Making Work Pay tax credit? In 2010, a single taxpayer is eligible for up to $400 while married couples qualify for a maximum of $800. In most situations, the credit is built into the withholding tables resulting in less tax taken out of your pay. To account for Making Work Pay credit this tax season, the IRS is asking individuals to file the Schedule M form with the 1040 and 1040A tax claims. For those who use the simplest return, 1040EZ, there's a work sheet on the back to compensate for the credit.

If you're not eligible for Making Work Pay credit, expect a change with the return amount from 2010. In fact, some taxpayers who normally get a small refund may owe this year because they didn't qualify for the credit.

Here's a list of those who should pay special attention to their withholding, according to IRS.gov:

- Pensioners

- Married couples with two incomes

- Individuals with multiple jobs

- Dependents

- Some Social Security recipients who work

- Workers without valid Social Security numbers

Not sure if you qualify for the $400 credit? Schedule M will help taxpayers sort out those issues. Also, filing through an online service like TurboTax will help clarify the Make Work Pay tax credit and save you from many errors that might not have been caught on paper.

As previously reported, the IRS unveiled a new

Thursday, March 3, 2011

Coupon guru explains the art of free shopping

When budgeting for the monthly basics, the idea that you could get some of the essentials for free sounds too good to be true. This isn’t just a possibility, insists coupon guru Kathy Spencer of Boxford, MA, but a lifestyle she’s maintained for years.

When budgeting for the monthly basics, the idea that you could get some of the essentials for free sounds too good to be true. This isn’t just a possibility, insists coupon guru Kathy Spencer of Boxford, MA, but a lifestyle she’s maintained for years.“I started at CVS six years ago with $8 out of pocket and since then I haven’t spent any real dollar bills in the store,’’ Spencer tells the Boston Globe. Through planning, attentiveness and, at times in the checkout line, a strong backbone she has saved her family thousands of dollars.

Spencer keeps an eye on circulars for supermarkets and pharmacies. Frequently coupons can be applied the same time as sales, making many everyday products free or earning the shopper rebates or credit. In these instances you can stock up on an item, cross it off the list and move on to other necessities.

An extension of this Spencer employs is called a “roll,” in which store credit is combined with in-store rewards. Credit used on items will often still earn dollar rewards, and if broken up over multiple purchases on low cost items, this can allow you to walk in with $10 in credit and walk out with $20 worth of household goods.

Ultimately “free,” requires the vigilance of keeping tabs on different stores and their discounts, the organization of knowing what household staples you’ll need over extended periods of time, and the restraint to know the difference between stocking up and hoarding an attic full of toilet paper.

Not everyone has the time or interest in this type of Rubix-cube style of shopping, however Spencer’s successes are based on basic ideas that will help you save regardless of your interest in following her step for step.

Click here for the complete article.

Inside Consumer United :: Omar Kazmi

Kazmi has talked to shoppers from rural farming communities and dense, bustling cities and helped them by acknowledging their insurance needs and preferences vary just as much as where they're from. With both New York and New Jersey auto teams, he has appreciated clients’ viewpoints and touted the importance of communication.

As a Consumer Advocate, Kazmi has worked hard not just to provide the best prices, but also to understand the best fit for consumers, whether it’s their preference for a local business with exceptional customer service or a national carrier with convenient features not offered elsewhere.

Raised off the coast of Southern India in Sri Lanka, Kazmi moved to the U.S. at the age of eight, landing first in Southern New Jersey and later in Framingham, MA. He attended Bentley University just outside of Boston, pursuing Business Management and International Studies. Active beyond the classroom, Kazmi volunteered at nearby soup kitchens and tutored local students, but also boxed on weekends and played water polo for the university.

Kazmi remains passionate about athletics and fitness but is also an avid reader. While he's ready with insight on a recent boxing match or MMA fight, Kazmi is just as bright, if a bit more modest, in discussing modern history. Kazmi's thoughtful approach as a Consumer Advocate continues to help the company's goal, and his range of interests and knowledge have made him a favorite in and out of the office.

Tuesday, March 1, 2011

Weekly Deals: Bundle Your iPod Package

Deal Of The Week:

Deal Of The Week:Best Buy: Members can save big when they bundle accessories with their MP3 player purchases. Get $23-$47 off select iPod player packages here until Saturday, March 5.

Other Weekly Deals:

Hotels.com: Looking forward to Fat Tuesday? Save up to 30 percent on Mardi Gras hotels until Tuesday, March 8 here.

Turbo Tax: Make tough times a little easier. File your simple return for FREE with TurboTax® Federal Free Edition. Click here to start saving.

Restaurant.com: Take 70% off $25 gift certificates from Restaurant.com with Consumer United's special code FORK through Tuesday, March 8 here.

Tuesday, February 22, 2011

IRS launches new tax refund smartphone app

Listen up smart phone users. The Internal Revenue Service (IRS) unveiled a new

Listen up smart phone users. The Internal Revenue Service (IRS) unveiled a new "This new smart phone app reflects our commitment to modernizing the agency and engaging taxpayers where they want when they want it," says IRS Commissioner Doug Shulman. "As technology evolves and younger taxpayers get their information in new ways, we will keep innovating to make it easy for all taxpayers to access helpful information."

Apple users can download the free IRS2Go application at the Apple App Store; Android users can go to the Android Marketplace.

"This phone app is a first step for us," Shulman adds. "We will look for additional ways to expand and refine our use of smart phones and other new technologies to help meet the needs of taxpayers."

The mobile app, among a handful in the federal government, offers a number of safe and secure ways to help taxpayers. Features include real-time updates on their refund status, which will work within about 72 hours after filing electronically, compared to four weeks using snail mail. Also, the IRS will send out daily tax tips through the app and offer additional news via their Twitter feed at @IRSnews.

Click here for the lowdown.

.JPG)